In the ever-evolving world of personal finance, ease of access and control over our resources has become a top priority. In this context, the UBA Credit Card emerges as a powerful tool, promising to transform the way we manage our money.

In this article, we’ll delve into how this revolutionary card works and explore its technical capabilities, its financial impact, and its viability in today’s scenario.

Unlocking the Technology

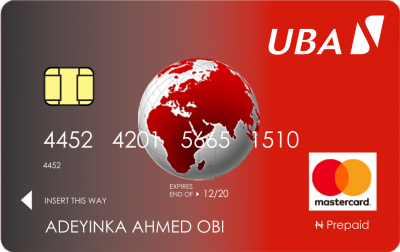

The UBA Credit Card stands out for its innovative technology, which combines security and practicality. Based on available information, this card uses state-of-the-art microchips, making transactions safer than ever. Advanced encryption protects cardholder data, minimizing the risk of fraud and identity theft.

In addition, NFC (Near Field Communication) connectivity enables contactless payments, a convenience that has gained prominence in recent years. By simply touching the card to a compatible payment terminal, transactions are completed quickly and securely.

Financial Empowerment

The UBA Credit Card is not just a payment tool; it is a means of financial empowerment. By offering a flexible line of credit, the card allows users to make purchases immediately and pay later, making it easier to manage unforeseen expenses and emergencies. This flexibility can be particularly advantageous for those looking to maintain a steady cash flow in all situations.

In addition, the UBA Credit Card provides an intuitive online portal where cardholders can monitor their spending, set spending limits and even create savings goals. This data-driven approach helps users make more informed financial decisions and maintain more effective control over their personal finances.

Rewards and Benefits Programs:

The UBA Card often includes rewards and benefit programs that reward users for their spending. This can include cashback, airline miles, discounts at partner establishments and access to exclusive events. These additional incentives make using the card even more attractive.

In some cases, the UBA Card offers access to special financial services, such as financing with advantageous conditions or differentiated installment options. This expands financial management possibilities and can be an advantage for certain user profiles.

The UBA Card is often accompanied by a mobile application that allows users to monitor their transactions, make payments, view invoices and receive real-time notifications. The practicality of this application further facilitates the monitoring of activities related to the card.

Financial Impact and Feasibility

In the current scenario, where mobility and practicality are crucial, the UBA Credit Card proves to be a financially viable choice. With its competitive interest rates and flexible payment options, the card caters to new and experienced financial consumers alike. However, it is essential that cardholders maintain sound financial discipline to avoid excessive debt and unnecessary financial burdens.

Pros:

Advanced Technology: The UBA Card uses microchips and state-of-the-art cryptography, offering greater security for transactions and protection against fraud.

Contactless Payments: NFC technology enables contactless payments, streamlining transactions and making the shopping experience more convenient.

Credit Flexibility: The UBA Card offers a flexible line of credit, allowing for immediate purchases and later payments, which can be useful in emergency situations.

Personalized Financial Management: The UBA Card online portal offers tools to monitor expenses, define limits and create savings goals, helping with personal financial management.

Competitive Rates: The card offers competitive interest rates compared to other options on the market, making it an affordable choice for many consumers.

Financial Empowerment: The UBA Card not only facilitates transactions, but also empowers users to make more informed financial decisions and better control their finances.

Cons:

Debt: The flexibility of credit can lead to irresponsible use and the accumulation of debt if spending is not properly monitored and controlled.

Fees and Charges: While fees for the UBA Card are competitive, there may still be fees associated with late or minimum payments, which can increase costs for cardholders.

Impulse Attractiveness: Ease of payment can encourage impulse purchases, leading to unnecessary spending and possibly damaging financial health.

Need for Discipline: To take full advantage of the UBA Card, cardholders must maintain strict financial discipline by avoiding overspending and managing payments effectively.

Technology Reliance: While technology is one of the key benefits of the card, over-reliance on it can be an issue for those who experience technical issues or prefer traditional payment methods.

Benefits of UBA Card Lines of Credit

The UBA Card stands out for offering lines of credit that are aligned with the individual needs and financial objectives of its holders. Some of the main benefits include:

Payment Flexibility: UBA Card lines of credit allow cardholders to make purchases and pay later, providing a window of time to accommodate payments based on cash flow.

Emergency Response: One of the biggest advantages of lines of credit is the ability to handle unexpected expenses, such as medical bills or emergency repairs, without resorting to short-term borrowing.

Financial Opportunities: UBA Card lines of credit can be used to take advantage of investment opportunities or advantageous purchases, even when available funds are limited.

Improvement of Credit Score: A responsible use of the line of credit can contribute to building or improving the holder’s credit score.

Conclusion

The UBA Credit Card emerges as an innovative solution that transcends the simplicity of traditional cards. With advanced technology, personal financial management features and a positive impact on finances, this card represents a modern approach to money management.

However, it’s critical to remember that, as with any financial tool, accountability and understanding the terms and conditions are crucial to fully enjoying its benefits.

*You will be redirected to another website.