In the ever-evolving world of personal finance, it’s crucial to be on the lookout for opportunities that can improve our financial management. Among the many tools available, credit cards play a central role in the way we conduct our daily transactions.

One such card that has been gaining attention is the Safeway Money Discovery Gold Credit Card. In this review, we will thoroughly examine the features and benefits offered by this card, with the aim of providing a comprehensive overview of how it works and how it can contribute to our financial lives.

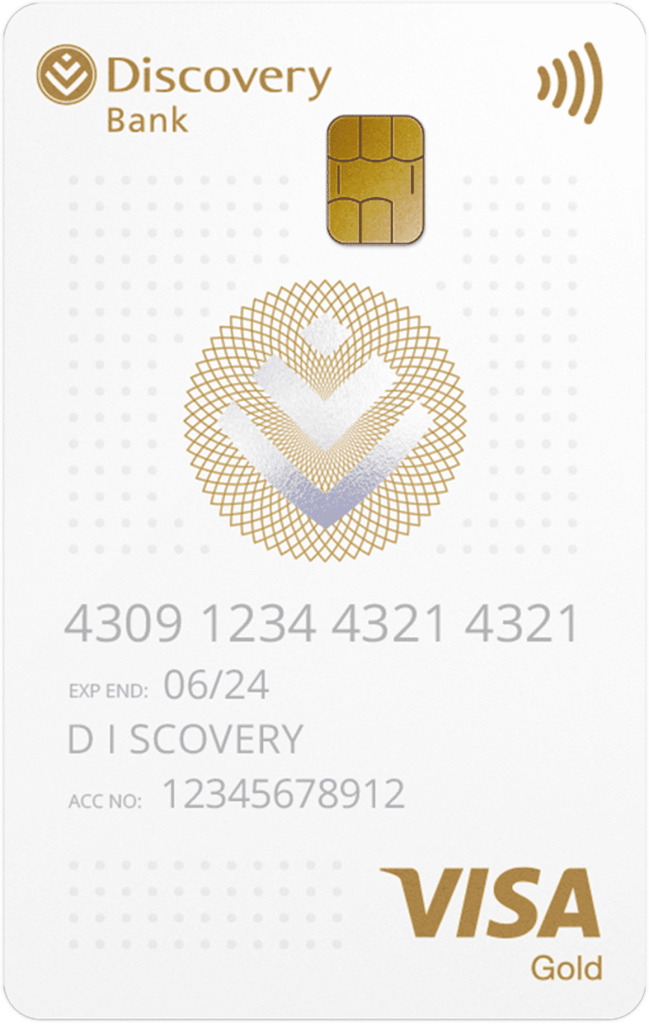

The Discovery Gold Credit Card is much more than just a piece of plastic in your wallet. This card offers an impressive combination of cutting-edge financial technology and significant benefits for cardholders. It is designed to meet the needs of modern customers, both in terms of functionality and security.

Notable Technical Features

One of the most notable technical features of the Discovery Gold Credit Card is the presence of an advanced security chip, which uses state-of-the-art cryptography to protect the cardholder’s information. This chip not only makes transactions more secure, but also enables contactless transactions, providing a fast and convenient payment experience.

Additionally, the card integrates with mobile apps and online platforms, allowing cardholders to track their spending, set spending limits and receive real-time alerts. This integration of technology with personal financial management is a big step towards more efficient financial control.

Exploring the Financial Benefits

The Discovery Gold Credit Card does not only stand out for its advanced technical features. It also offers a variety of financial benefits that can improve users’ financial experience.

Generous Cashback

One of the most attractive offers on the card is the cashback program. With each transaction made, cardholders can accrue a percentage of the amount spent, which is credited back to the account. This feature is a smart way to save money while doing routine shopping.

Rewards Program

In addition to cashback, the Discovery Gold Credit Card offers a comprehensive rewards program. Each purchase contributes to the accumulation of points that can be exchanged for a variety of benefits, such as travel, electronic products and shopping vouchers. This rewards program adds an exciting touch to the experience of using the card.

Discovery Gold Credit Card Pros:

Advanced Security Technology: The security chip and state-of-the-art encryption offer a high level of protection against fraud and data theft, providing cardholders with greater peace of mind.

Contactless Transactions: The ability to perform contactless transactions streamlines the payment process, increasing convenience and in line with current hygiene trends.

Generous Cashback Program: The cashback program allows cardholders to save money with every transaction, making everyday purchases more rewarding and providing an effective way to save.

Attractive Rewards Program: The rewards program offers a wide range of benefits, from travel to electronics, encouraging users to accumulate points and enjoy additional benefits.

Integration with Mobile Technology: The ability to track expenses, set limits and receive alerts in real time through mobile applications and online platforms offers more effective financial control.

Ease of Use Internationally: The card is generally accepted internationally, making it a convenient option for travelers and those shopping online at foreign sites.

The Discovery Gold Credit Card stands out for several reasons, making it an attractive choice among the numerous credit cards available on the market. Its combination of advanced technological features, solid financial benefits and a user-centric approach sets it apart. Here are some ways Discovery Gold stands out:

Cutting-edge Security Technology: The most obvious highlight of Discovery Gold is its emphasis on security. The security chip incorporates advanced encryption, making transactions more secure and protecting the cardholder’s personal information from fraud and cyberattacks.

Contactless Transactions: In a world increasingly geared towards convenience and hygiene, contactless transactions are an innovative feature of Discovery Gold. This functionality not only streamlines the payment process, but also perfectly aligns with consumer expectations in a post-pandemic scenario.

Attractive Financial Benefits: The card is not just about technology; it also offers considerable financial benefits. The generous cashback program allows users to save money with every transaction, which can be a significant incentive for regular card usage.

Discovery Gold Credit Card Cons:

Fees and Interest: Like many credit cards, Discovery Gold may have annual fees and interest associated with any balance not paid in full. These fees can erode accrued benefits if the holder is not diligent about payments.

Potential for Overspending: The contactless payment facility and rewards programs can encourage impulsive and overspending, resulting in unplanned debt.

Eligibility Requirements: Some premium credit cards, such as Discovery Gold, may have stricter credit and income requirements to be eligible. This can make access difficult for some consumers.

Complexity of Terms and Conditions: As with many cards, the terms and conditions can be complex and include hidden details. Cardholders should take the time to fully understand the financial implications.

Credit score Discount: Opening a new credit card can have a temporary impact on cardholders’ credit score, which may affect their eligibility for future loans or credit cards.

Responsible Use Required: Like any credit card, responsible use is paramount. If not managed prudently, the card can lead to troubled debt and negatively impact the cardholder’s financial health.

Final considerations

Safeway Money’s Discovery Gold Credit Card emerges as an intriguing option for those seeking a powerful financial tool. With its combination of advanced technological features, solid security measures and attractive financial benefits, this card stands out in the competitive credit card market.

However, it is important to remember that any credit card requires responsible use to avoid excessive debt. Ultimately, the decision to purchase the Discovery Gold Credit Card should be based on a thorough understanding of its features and alignment with individual financial needs.

In a world where technology is rapidly changing the way we handle finances, the Discovery Gold Credit Card emerges as a compelling example of how innovation can be combined with practicality. If you are looking for a financial tool that offers security, benefits and a modern touch, this card is certainly worth your consideration.

*You will be redirected to another website.