LendingClub offers a variety of personal loan options tailored to diverse borrower needs. Whether you’re seeking to consolidate debt, cover medical expenses, fund home improvements, or embark on a vacation, their loan types cater to an array of financial objectives.

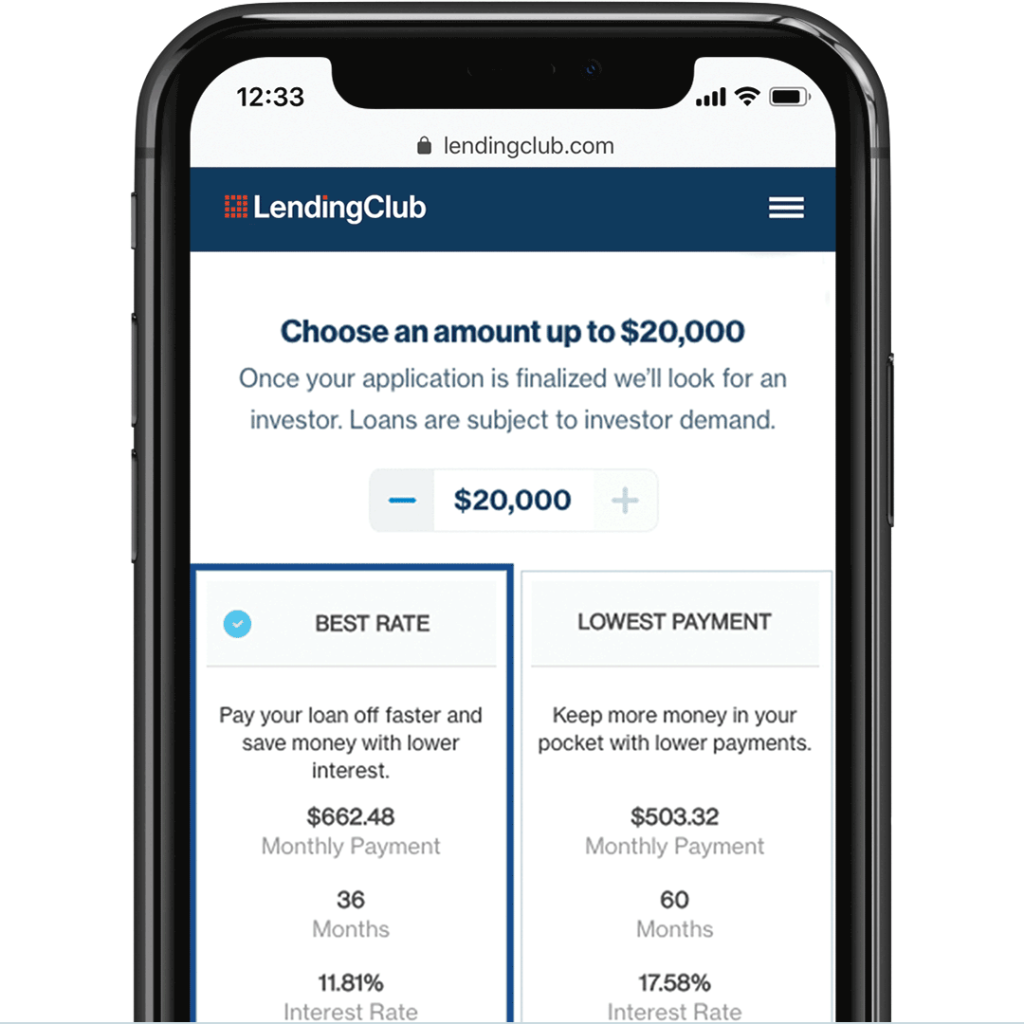

Fixed-rate loans with terms ranging from 3 to 5 years form the cornerstone of LendingClub’s offerings. Borrowers can secure loans ranging from $1,000 to $40,000, providing ample flexibility for varying financial requirements.

Pros and Cons

Ventajas:

Competitive Interest Rates: LendingClub’s interest rates often start at competitive levels, making it an appealing option for borrowers with decent credit scores.

Transparent Fees: The platform is upfront about its fees, including origination fees, which can range from 2% to 6% depending on the borrower’s creditworthiness.

No Prepayment Penalties: Borrowers can pay off their loans early without incurring any prepayment penalties, helping them save on interest.

Contras:

Origination Fees: While the transparency is commendable, the origination fees might be a deterrent for some borrowers, as they can reduce the actual loan amount received.

Minimum Credit Score: LendingClub typically requires a minimum credit score of around 600, which might exclude individuals with lower credit scores.

Application Process

Applying for a personal loan through LendingClub is a straightforward process. Prospective borrowers can begin by completing an online application, which involves providing personal and financial details.

The platform then performs a soft credit inquiry, allowing potential borrowers to see their loan offers without affecting their credit score. If the offer aligns with their needs, borrowers can proceed to a hard credit inquiry, which finalizes the loan terms.

Transparent Fees: A Closer Look at LendingClub’s Cost Structure

When considering a personal loan, one of the critical aspects borrowers must evaluate is the fee structure associated with the loan. LendingClub, a prominent player in the online lending space, has gained attention for its commitment to transparent fees.

This transparency is a pivotal factor in helping borrowers make informed financial decisions. LendingClub’s fee structure encompasses several key components that borrowers should be aware of before committing to a loan:

Origination Fees: Origination fees are charges levied by the lender for processing and facilitating the loan. LendingClub’s origination fees typically range from 2% to 6% of the loan amount. The specific percentage is determined based on factors like the borrower’s creditworthiness, loan term, and loan amount.

It’s important to note that origination fees are deducted from the loan amount before it’s disbursed to the borrower. This means that if a borrower is approved for a $10,000 loan with a 4% origination fee, they would receive $9,600 after the fee deduction.

Interest Rates: LendingClub offers competitive interest rates that can vary based on the borrower’s creditworthiness and the loan term. The interest rate directly affects the overall cost of the loan. Borrowers with higher credit scores typically qualify for lower interest rates, which can significantly impact the total amount repaid over the life of the loan.

Late Payment Fees: If a borrower misses a payment deadline, late payment fees may apply. These fees can vary, so it’s crucial for borrowers to understand the late payment policy and associated charges. Being aware of these fees can help borrowers avoid unnecessary financial stress.

Prepayment Penalties: LendingClub stands out by not imposing prepayment penalties on borrowers who choose to pay off their loans ahead of schedule. This can be a substantial advantage for borrowers who want to save on interest by repaying their loans early.

Check Processing Fees: For borrowers who opt to receive their loan funds via paper check, LendingClub may charge a check processing fee. However, choosing electronic fund transfer or direct deposit can help borrowers avoid this additional cost.

Loan Application and Approval Timeline

The timeline from application to loan disbursement varies but generally follows these steps: Application: The initial application can be completed within minutes, requiring basic personal and financial information. Loan Offer Review: After a soft credit inquiry, borrowers receive loan offers with various terms and interest rates.

Credit Inquiry: If a borrower accepts an offer, a hard credit inquiry is conducted to finalize the terms. Verification and Approval: LendingClub reviews the borrower’s financial information and may request additional documents for verification.

Funding: Once approved, the loan is listed on the platform for investors to fund. Once fully funded, the loan is disbursed to the borrower’s account, which can take a few days.

Practical Examples of Using LendingClub Personal Loans

LendingClub’s personal loans are versatile financial tools that can be applied to various real-life scenarios. Here are a few practical examples of how borrowers might utilize these loans to achieve their financial goals:

Debt Consolidation:

Jane has accumulated credit card debt across multiple cards, each with high interest rates. By taking out a personal loan from LendingClub, she can consolidate all her credit card balances into a single loan with a potentially lower interest rate. This allows her to manage her debt more effectively and save on interest payments over time.

Home Improvement:

Mike wants to renovate his kitchen, but he lacks the immediate funds to cover the costs. With a LendingClub personal loan, he can secure the necessary funds for the renovation. The fixed monthly payments and clear repayment schedule help him manage the expenses while enhancing the value of his home.

Medical Expenses:

Sarah faces unexpected medical expenses after an accident. Her health insurance doesn’t cover all the costs, and she needs to cover the remaining amount quickly. A personal loan from LendingClub provides her with the necessary funds to pay the medical bills and provides a structured repayment plan.

Emergency Situations:

David’s car unexpectedly breaks down, and he relies on it for his daily commute. Without a functioning vehicle, he could risk losing his job. A personal loan from LendingClub allows him to repair his car promptly, ensuring he can continue working without disruptions.

Wedding Costs:

Emily and Mark are planning their dream wedding, but the expenses are adding up. A LendingClub personal loan can help them cover the costs of the venue, catering, and other essential elements of their special day. They can repay the loan over time while starting their married life on a positive note.

Travel and Vacation:

John and Lisa have always dreamed of taking a trip to Europe. By taking out a LendingClub personal loan, they can fund their dream vacation and experience new cultures and adventures. With fixed monthly payments, they can budget for their trip and create lasting memories.

Education and Training:

Jennifer wants to enroll in a professional course to enhance her skills and career prospects. The course requires upfront payment, which she can’t afford at the moment. A personal loan from LendingClub helps her invest in her education, potentially leading to better job opportunities and increased earning potential.

Small Business Expansion:

Mark runs a small business and sees an opportunity for expansion. To seize this opportunity, he needs to invest in new equipment and inventory. A LendingClub personal loan provides him with the capital he needs to grow his business and take it to the next level.

Conclusion

LendingClub’s personal loans present a compelling option for individuals seeking flexible financing solutions. With a range of loan types, competitive interest rates, and a transparent fee structure, it caters to various financial needs. However, potential borrowers should be aware of the origination fees and the minimum credit score requirement.

The application process, while streamlined, involves several steps from initial inquiry to loan disbursement. As with any financial decision, thorough research and a clear understanding of the terms are imperative before committing to a personal loan.