Establishing a favorable Credit History: Using a credit card responsibly and paying on time helps develop a favorable credit history. A solid credit score is essential for future loan applications, flat rentals, and even certain employment chances.

Convenience: Credit cards make it easy and secure to make transactions both in-store and online. They remove the need for currency and give an extra degree of security against fraud and unauthorized transactions. Emergency Fund: When you don't have enough cash on hand, credit cards might function as a backup. They may cover unforeseen costs such as auto repairs or medical bills until you are able to pay them off.

Benefits & Rewards: Many credit cards include rewards programs, cashback, or travel points for every dollar spent. These points may be accumulated over time and used for discounts, rebates, travel, or other benefits.

Buyer Protection: Credit cards often have built-in buyer protection, which may be useful if you have problems with a transaction, such as getting a faulty product or being a victim of fraud. You may be able to contest the charge and get a refund.

Travel Benefits: Some credit cards provide travel insurance, free airport lounge access, no foreign transaction fees, and travel-related discounts. Credit Card Benefits: Depending on the credit card, you may be eligible for benefits such as extended warranties, price protection, and purchase protection, all of which may improve your entire shopping experience.

Credit card statements give a thorough record of your expenditure, making it simple to manage costs and budget successfully. Online purchasing protection: Credit cards provide an additional degree of protection while purchasing online. In the event of fraudulent charges, you have the option to challenge them and avoid being out of money.

Cash Flow Management: Credit cards enable you to make quick purchases and pay the amount later. This might help you manage your financial flow, particularly if your income isn't matching your spending.

While credit cards provide many benefits, it is important to use them wisely to avoid becoming in debt. Paying off your credit card amount in full each month and not exceeding your credit limit can save you from collecting high-interest debt and allow you to fully enjoy the benefits of owning a credit card.

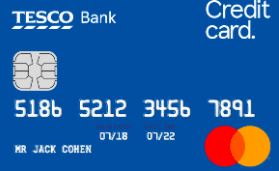

How can I get “Tesco Foundation Credit Card”?

To get a credit card, follow these basic steps: Check your credit score: Knowing your credit score is vital before applying for a credit card. Credit bureaus provide free credit reports, and other internet options are available. A strong credit score boosts your chances of being accepted and receiving better credit card conditions.

Research and compare credit cards: There are many different types of credit cards available, each with its own set of features and perks. Investigate several credit card alternatives and compare their interest rates, annual fees, rewards programs, and other criteria to choose one that best meets your requirements and financial circumstances.

Determine eligibility: Examine the eligibility requirements for the credit cards you're considering. Check that you fulfill the criteria for age, income, and credit history. Apply online or in person: If the issuer has physical locations, you may apply for a credit card online via the issuer's website or in person at a local branch. Fill out the application form completely with correct personal and financial information.

Submit needed documentation: Some credit card applications may include the submission of supporting documents such as proof of income, identification verification, and address verification. If required, be prepared to deliver these. Wait for approval: Your application will be reviewed by the credit card company, which may take some time to complete. If you are authorized, your credit card will be sent to you.

Activate your credit card: After receiving your credit card, you must activate it. This is often accomplished by phoning the issuer or activating it online. Stick to the directions on the card. Begin using your credit card responsibly: After activation, you may begin making transactions with your credit card. Remember to use it wisely and pay on time to get a good credit history.

Keep track of your spending and payments: Keep track of your credit card usage and keep within your credit limit. To minimize interest costs and preserve a decent credit score, try to pay off your bill in full each month.

It is important to understand that obtaining a credit card involves financial responsibility. If you use your credit card carefully and pay on time, it may be a helpful instrument for building credit and gaining access to numerous bonuses and incentives. However, irresponsible credit card use may lead to debt and have a bad influence on your credit score. Spend within your means at all times and only use credit cards for goods you can afford to pay off.

Are there any limitations to obtaining a credit card?

Yes, there are some limits and eligibility requirements that people must complete in order to get a credit card. These limitations may differ based on the country and the financial institution providing the credit card. The following are some frequent variables that may affect your eligibility:

Age: To apply for a credit card on your own, you must be at least 18 years old. Some nations may demand a higher minimum age. Income: You must have a consistent source of income in order to establish that you can repay the credit card debt. Some credit card companies may have income limitations.

Credit history: Having a strong credit score and a positive credit history boosts your chances of being authorized for a credit card. A strong credit score demonstrates that you have a track record of borrowing responsibly and repaying loans or obligations.

job status: Credit card companies often look at your job status since it shows your capacity to make timely payments. Legal status: To apply for a credit card in many countries, you must be a citizen or a legal resident.

Debt-to-income ratio: Your debt-to-income ratio, which compares your total monthly debt payments to your monthly income, may be considered. Previous credit card delinquency: If you have a history of missing credit card payments, your eligibility for a new card may be impacted.

Bankruptcy: If you have previously filed for bankruptcy, it may limit your ability to receive a credit card. Before applying, it is critical to review the credit card issuer's unique restrictions and qualifying criteria. Applying for many credit cards at the same time may also harm your credit score, so do your homework and choose a card that fits your financial condition and requirements.

*You will be redirected to another website.