Earnest offers an assortment of personal loans tailored to cater to diverse financial requirements. Whether you’re consolidating debt, funding home improvements, or managing unexpected medical expenses, Earnest has you covered.

Their loan offerings encompass fixed-rate loans and variable-rate loans. Fixed-rate loans provide the stability of a consistent interest rate over the loan term, while variable-rate loans offer the potential for lower initial rates that may change over time.

The Pros: A Closer Look at the Benefits

Earnest stands out with its approach to lending, focusing on individual merit rather than just credit scores. This approach can be a boon for borrowers with thin credit histories or non-traditional sources of income. Their precision in assessing loan applicants includes factors such as education, career trajectory, and financial behavior.

Earnest’s approach to lending goes beyond the conventional reliance solely on credit scores to assess a borrower’s eligibility and financial capability. This approach reflects a recognition that an individual’s financial situation is multi-dimensional and can’t be accurately summarized by a single metric like a credit score.

Earnest takes a holistic view of a borrower’s financial health. Instead of relying solely on credit scores, they consider a range of factors that provide a more comprehensive understanding of an individual’s financial responsibility and potential.

This can include educational background, employment history, income trajectory, savings patterns, and more. By evaluating a broader spectrum of financial indicators, Earnest aims to provide a fairer and more accurate representation of a borrower’s creditworthiness.

Credit scores can sometimes be influenced by past financial mistakes or circumstances that may not fully reflect an individual’s current financial stability. Earnest’s approach acknowledges that people’s financial situations can change over time.

For instance, someone who had a lower credit score due to medical bills or student loans but has since improved their financial habits and income might still be a responsible borrower. Earnest’s emphasis on current financial behaviors and future potential can benefit individuals who are working to build a stronger financial foundation.

Earnest also considers alternative data sources beyond traditional credit reports. This might include analyzing a borrower’s transaction history, savings patterns, and even educational attainment. By incorporating these additional data points, Earnest aims to uncover positive financial behaviors that might not be evident from a credit score alone.

Benefiting Borrowers with Thin Credit Files:

One of the significant advantages of Earnest’s approach is its potential to assist borrowers with thin or limited credit histories. Young adults who are just starting their financial journey or immigrants who haven’t had the chance to establish extensive credit profiles might find it challenging to secure loans from traditional lenders.

Earnest’s personalized evaluation can open up lending opportunities for these individuals based on their demonstrated financial behaviors and future potential. Earnest’s approach to lending aligns with a broader effort to create a more inclusive and equitable lending environment.

By moving away from strict credit score cutoffs, they aim to provide financial assistance to individuals who might have been overlooked by traditional lending models. This not only benefits borrowers but also contributes to a more accurate representation of their creditworthiness.

Moreover, the flexibility offered by Earnest is noteworthy. Borrowers can customize loan terms, choosing repayment durations ranging from 1 to 5 years. This adaptability empowers borrowers to align their loan structure with their financial goals.

The Cons: Scrutinizing the Drawbacks

While Earnest’s approach is innovative, it might not be suitable for everyone. The meticulous evaluation process could mean a longer application time compared to some other lenders. Additionally, those seeking larger loan amounts might find Earnest’s maximum loan limit restrictive.

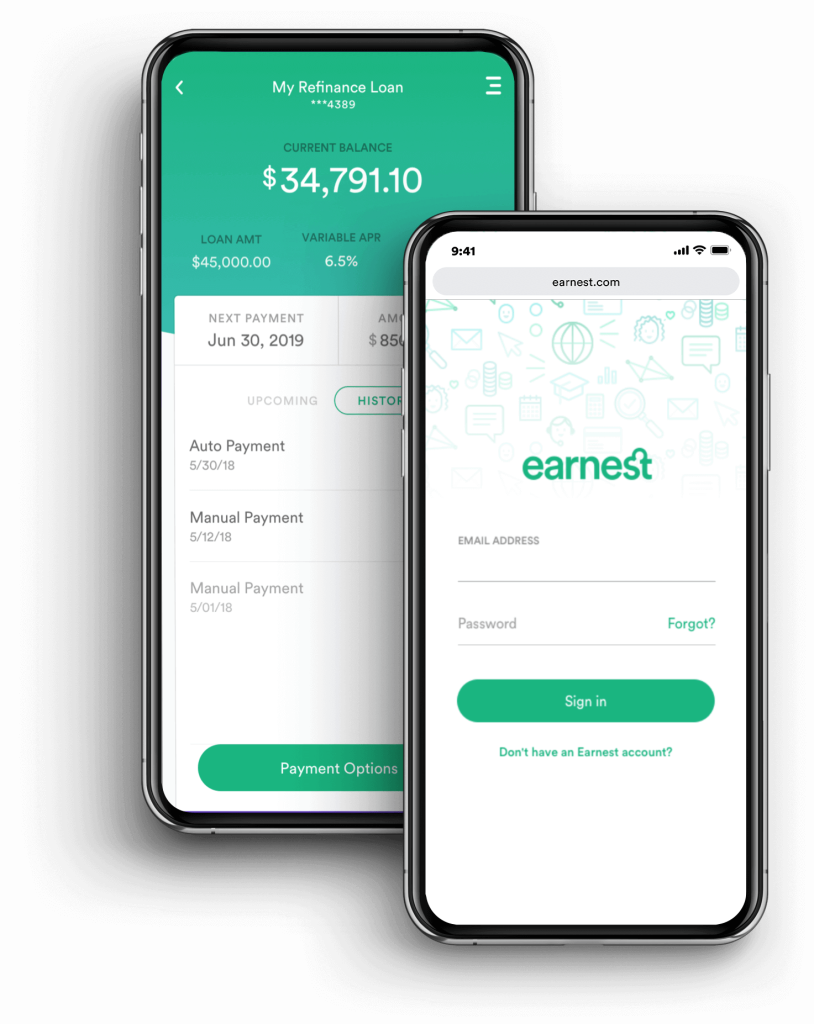

The Application Process: Streamlined and Digital

Applying for an Earnest personal loan is a straightforward digital process. The journey commences with an online application where you’ll provide information about your finances, income, and desired loan amount. To bolster their assessment, Earnest requires access to your financial accounts, allowing them to gain insights into your financial behavior.

Behind the Scenes: The Interest Rate Conundrum

One of the pivotal aspects of any loan is the interest rate. Earnest’s variable-rate loans are linked to the 1-month London Interbank Offered Rate (LIBOR) plus a margin that is determined by your creditworthiness. This unique setup means your interest rate might vary during the loan tenure, potentially leading to fluctuations in your monthly payments.

Variable Interest Rates Linked to LIBOR:

Earnest offers both fixed and variable interest rate options. When it comes to variable rates, they are typically linked to the London Interbank Offered Rate (LIBOR). LIBOR is an important benchmark interest rate that reflects the average interest rate at which major global banks lend to one another.

However, it’s important to note that as of my last knowledge update in September 2021, there were ongoing discussions about phasing out LIBOR due to concerns about its reliability, and alternative reference rates were being explored.

Customized Margins:

Earnest’s approach involves adding a “margin” to the LIBOR rate to determine the variable interest rate for each borrower. This margin is influenced by factors such as your creditworthiness, financial profile, and other relevant details. Essentially, the margin is a reflection of the lender’s assessment of your risk as a borrower.

Borrowers with stronger credit profiles may receive a lower margin, resulting in a more favorable interest rate, while those with higher perceived risk might have a higher margin and, consequently, a higher interest rate.

Potential for Fluctuations:

One of the key points to understand about variable interest rates is their potential for fluctuation. Since LIBOR can change over time based on market conditions, your interest rate might also change.

This means that while you might start with a lower rate compared to a fixed-rate loan, your rate could increase in the future, leading to changes in your monthly payments. The variability of interest rates adds an element of uncertainty to your loan, and it’s important to consider your risk tolerance and ability to manage potential rate increases.

Considering the Future:

As you explore Earnest’s variable interest rate offerings, it’s crucial to factor in your financial outlook and economic conditions. If you anticipate that interest rates might rise over the course of your loan term, it’s important to assess whether you can comfortably manage potential increases in your monthly payments.

In Conclusion: Your Financial Future with Earnest

The blend of pros and cons makes it crucial for potential borrowers to carefully weigh their financial needs, repayment capabilities, and the desire for flexibility.

Before diving in, it’s advisable to explore alternative lenders, compare interest rates, and delve into the fine print. With the right research and a clear understanding of your financial roadmap, Earnest’s personal loans could be the stepping stone toward achieving your monetary aspirations.

As with any financial decision, it’s imperative to conduct thorough research and consult financial experts to ensure the best path for your unique circumstances.